2025.04.17

Mitsubishi UFJ NICOS enables users of vending machines to make contactless payments with a credit card!

Aiming to promote the use of credit cards for micropayments

The scope of contactless payment by credit card has been expanded to include micropayments. This payment method is becoming available at vending machines installed at Mitsubishi Group companies as well as company canteens.

Mitsubishi UFJ NICOS has formed a partnership with developers and suppliers of vending machine payment terminals IT Access and Nippon Conlux to roll out an added option for contactless payment using an IC credit card. Through this partnership, Mitsubishi UFJ NICOS aims to increase the number of vending machines able to offer contactless credit card payments to 500,000 units within five years.

The number of vending machines equipped with the two companies’ payment terminals has already exceeded 150,000 units nationwide in Japan. Consumers using these machines can make payments with electronic money or by scanning a QR code. Contactless payment by credit card will be added to these transaction methods, enabling users to make a payment by simply tapping their contactless IC card over the terminal without having to provide a signature or enter a passcode.

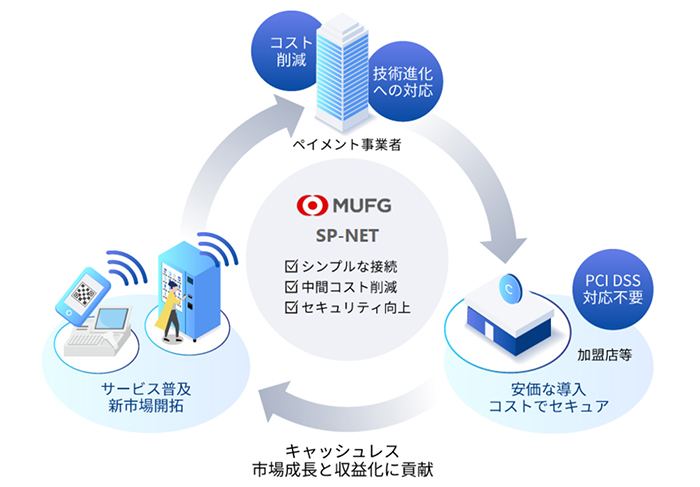

This initiative is characterized by the effective use of MUFG Bank’s SP-NET payment network, which is based on the concept of “SimplePayment.” For comfortable, safe and secure payments by credit card, SP-NET helps reduce the costs related to the processing of credit card payments by allowing payment terminals to connect directly to the network. This eliminates the need for costly information processing by an intermediary and thus removes one of the barriers in promoting cashless transactions. The processing of payment information on the network has also been simplified to make it easier and low-cost, and SP-NET provides a secure payment environment that complies with the Payment Card Industry Data Security Standard (PCIDSS).

Characteristics of SP-NET

SP-NET is utilized exclusively by Mitsubishi UFJ NICOS

Hiroki Fukuda has been seconded from Mitsubishi UFJ NICOS to MUFG Bank and serves as senior manager at the Payment Strategy Office within the bank’s Digital & Payment Planning Division. He explains the project as follows:

“For micropayments, it used to be difficult to use credit cards due to the cost structure. Accordingly, IC cards provided by public transportation companies and coins have been the main means of payment for vending machines. But contactless payment by credit card on a smartphone will eliminate the need to take out your wallet. This contactless payment method is widely utilized outside Japan, and making it more available will also be useful in dealing with inbound demand.”

Japan is behind other countries in terms of contactless payment by credit card. According to Visa, this method accounts for 90% of face-to-face payments in Europe and Africa and it is also becoming more widespread in Asia. By contrast, the diffusion rate in Japan sits at around 40%, or less than half. To increase the rate, contactless payment by credit card must also be made available for micropayments.

“Of course, we aim to make the payment method competitive with other methods,” adds Mr. Shimizu. “Compared with other cashless payment methods, the cost of using a credit card is said to be higher, and for micropayments by credit card the fees imposed on member merchants did in fact used to be high. In response, we have built infrastructure to reduce the fees for micropayments, thereby facilitating the introduction of this method.”

The cost structure that supports micropayment by credit card was established with the use of the SP-NET payment network service, which MUFG Bank launched in April 2023.

“For micropayments, it has conventionally been difficult for credit card companies to set fees that are acceptable to member merchants due to issues related to the cost structure,” explains Mr. Fukuda. “However, the use of SP-NET has made it easier for the two sides to agree on reasonable fees that are acceptable to both, which has in turn facilitated the introduction of the payment method.”

Moreover, the use of SP-NET is presently promoted exclusively by Mitsubishi UFJ NICOS, which gives the company an advantage with regard to micropayments.

Introduction of contactless payment by Mitsubishi Group companies

The introduction of contactless payment by credit card has been promoted for vending machines since December 2024. So has the actual rate of payments made using this method increased? “The rate is higher than expected,” says Mr. Fukuda, “but we are yet to see wide recognition that payment by credit card is possible for vending machines.” “Our next challenge is to make more vending machine users aware that this is available. To this end, we need to conduct a campaign and promotional activities, including broadcasting a commercial.” On the other hand, there are concerns about the security of this payment method, as anyone who gets hold of a credit card can easily use it to make a contactless payment. In response to these concerns, Mitsubishi UJF NICOS has set an upper limit on the payment amount. In addition, as Ryota Shimizu from Corporate Business Group 2, Corporate Business Promotion Department 4 at Mitsubishi UFJ NICOS explains, “Many of these terminals are designed without the capacity to store credit card information, which is done to prevent skimming and ensure the safe and secure use of credit cards for vending machines.”

In Japan, contactless payments by credit card are presently limited to leading restaurants and retailers as well as public transportation facilities, so there is a lot of room for expansion. In order to make contactless payment by credit card more widespread in Japan, it is necessary to include all kinds of micropayments in the target. Accordingly, Mitsubishi UFJ NICOS is planning to expand the payment method to luggage lockers and amusement facilities such as game arcades, in addition to vending machines.

Illustrative image of a payment terminal (provided by IT Access)

“There are stores where credit cards cannot be used for micropayments,” says Mr. Fukuda. “Even though leading merchants have already introduced contactless payment by credit card for micropayments, smaller businesses are hesitating to follow suit due to the cost. Going forward, however, we will work to popularize this payment method by taking advantage of SP-NET, which is owned by the MUFG Group.”

Now that credit cards can also be used for micropayments, Mr. Fukuda and Mr. Shimizu want Mitsubishi Group companies to introduce vending machines that support this contactless payment method. They also have the following message for employees of Group companies:

“For some of the vending machines installed at the offices of Mitsubishi Group companies, payment by credit card will soon become possible. If you find such a machine at your place of work, we would encourage you to make a contactless credit card payment next time you buy something. We also aim to foster cashless payment including by credit card at company canteens. If you have any inquiries, please do not hesitate to contact us using the details provided.”

Inquiries

Shimizu

Corporate Business Group 2, Corporate Business Promotion Department 4

Mitsubishi UFJ NICOS Co., Ltd.

03-5296-1342

r.shimizu01@cr.mufg.jp

Fukuda

Payment Strategy Office, Digital & Payment Planning Division

MUFG Bank, Ltd.

050-3842-8840

hiroki_fukuda@mufg.jp

INTERVIEWEES

HIROKI FUKUDA

Senior Manager, Payment Strategy Office

Digital & Payment Planning Division

MUFG Bank (seconded from Mitsubishi UFJ NICOS)

RYOTA SHIMIZU

Corporate Business Group 2,

Corporate Business Promotion Department 4

Mitsubishi UFJ NICOS Co., Ltd.

Akihabara UDX, 4-14-1 Sotokanda, Chiyoda-ku, Tokyo

Name changed to Mitsubishi UFJ NICOS Co., Ltd. in 2007. Engages in a range of businesses as the issuer of the Mitsubishi UFJ Card, MUFG Card, DC Card and NICOS Card. As one of the core companies of Mitsubishi UFJ Financial Group, Inc., Mitsubishi UFJ NICOS supports the development of a comfortable, safe and secure cashless society by providing a range of payment services, including issuing personal and business credit cards, introducing payment systems to member merchants, and providing financial institutions with card-issuing services.