2025.03.13

Brilliant achievement! Why was “New NISA & Orukan investment” ranked No. 1 in the article on the top 30 hit products for 2024? “The growth of Orukan is attributable to investors.”

eMAXIS Slim All Country is an investment trust fund managed by Mitsubishi UFJ Asset Management. This fund is called “Orukan” as an abbreviated pronunciation of “All Country” in Japanese, and the company registered the abbreviated name as a trademark for the fund in Japan. Why was this investment product, listed as “New NISA & Orukan investment,” selected to be No. 1 in an article on the top 30 hit products for 2024 published in the December 2024 issue of Nikkei Trendy?

The eMAXIS Slim All Country investment trust fund set up and managed by Mitsubishi UFJ Asset Management was ranked No. 1 under the name “New NISA & Orukan investment” among the top 30 hit products introduced in the December 2024 issue of Nikkei Trendy. It is rare for an investment trust fund product to appear in this annual ranking of hit products.

Orukan is an all-country stock index fund. Since the January 2024 launch of the upgraded New NISA scheme in Japan, the fund has remained at the top of the pack in terms of purchases made through New NISA accounts. Presently, the balance of the fund totals around 5,100 billion yen. As of the end of 2023, it was roughly 1,800 billion yen. This sharp increase makes the fund a history-making hit product in the investment trust market.

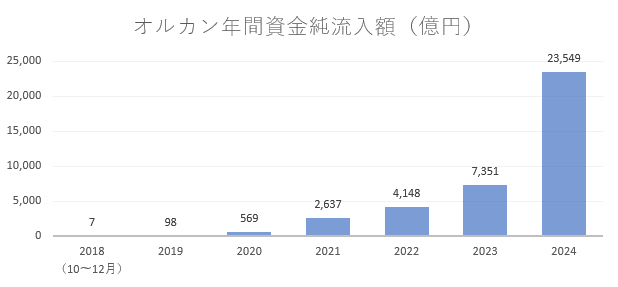

The fund has continued to be popular even despite the sharp swings in the Japanese equity market in August 2024, with its annual capital inflow reaching roughly 2,354.9 billion yen. This represents the largest figure among publicly offered investment trusts (excluding ETFs) and a near tripling of the amount recorded in 2023 (735.1 billion yen). So why has it attracted so many investors? Hiroaki Nojiri, group manager of the Promotion Strategy Group at the Customer Communication Division of Mitsubishi UFJ Asset Management explains as follows.

Annual inflows of capital into the eMAXIS Slim All Country fund

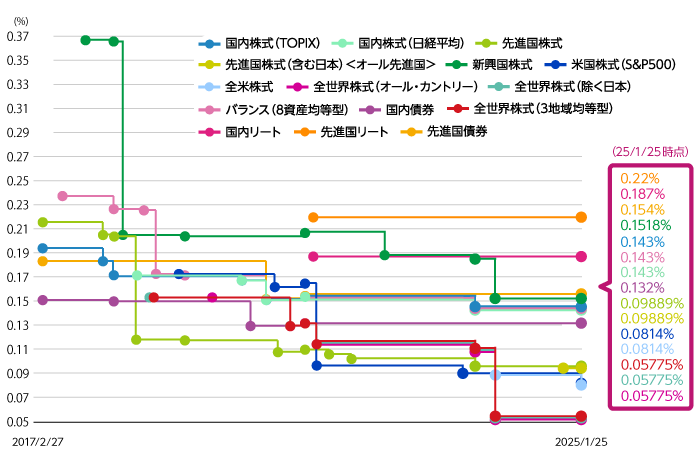

“First of all, the launch of the New NISA scheme, which represents a substantial upgrade of the conventional NISA scheme, provided Orukan with a tremendous driving force,” he says. “Toward the launch of the New NISA scheme, the net inflow of capital into the fund began to increase in December 2023 to reach 342.9 billion yen in January 2024, up more than 100 billion yen over the period. Subsequently, the inflow of capital into the fund totaled ** billion yen as of January 17, 2025, the second year of the New NISA scheme, thus increasing at a faster pace relative to the previous year. The product also attracts investors because of its fee rate of 0.05775% or less, the lowest in the industry. Moreover, in these uncertain times, it allows investors to invest in a range of stocks (around 2,700 names across 47 countries), making the product one that allows distributed investments under the New NISA scheme, which puts no limit on the tax-free period.

Orukan is offered under the eMAXIS Slim series. eMAXIS Slim US Stocks (S&P500) (“Slim S&P500”) is also popular among investors. Mitsubishi UFJ Asset Management is striving to keep management costs for the series at the industry’s lowest level, and the management costs for Orukan having been lowered four times already. The fact that the company has been keeping its promise to investors in line with the eMAXIS Slim concept has also contributed to increasing investor trust in the fund and helped it to attract even more investors. The number of Orukan account holders is estimated to presently be around five million people in total.

Proactively holding “fan meetings” and “blogger meetings” for investors

Why could the company make such a breakthrough with the Orukan fund? Mr. Nojiri is willing to hazard some guesses. “The growth of the fund is largely attributable to investors,” he says. “Although it is rare for a financial company like ours to hold events for retail investors, we have frequently held such events for this product. Dubbing these events ‘fan meetings’ and ‘blogger meetings,’ we used the opportunities to talk to investors, which I think has been a great help in making the fund a success. Prior to this product, we were offering a similar product that did not include Japanese stocks in the investment target. In response to insistent requests from investors, we released this product, which also includes Japanese stocks. Furthermore, I think the fact that lots of investors began to affectionately refer to the product as ‘Orukan’ has also helped increase its popularity.”

Information about the Orukan fund is regularly shared on the “Orukan Hiroba” website, including easy-to-understand graphics-based explanations for novice investors.

The company has also been sharing details about the Orukan fund, including its aims and ideals, what kind of fund managers it has and what to do when the market price drops, in order to ensure that investors remain well informed. According to Mr. Nojiri, this effort has also greatly contributed to the success of the fund.

“Investment trust products are intangible goods, so we attribute even more importance to earning investor trust,” he says. “We have also been highlighting the appeal of financial products in a manner that is visible to people—although this is not easy to do due to the nature of these products—and I think this has helped us differentiate our products from others.”

Many of the companies that have proactively been promoting communication with investors in the investment trust fund market are asset management companies that sell products directly to customers under the leadership of renowned charismatic fund managers. In contrast, large asset management companies like Mitsubishi UFJ Asset Management did not previously emphasize communication with investors.

“As one of our unique initiatives, we have been proactively communicating our concepts and ideas about the eMAXIS series since its launch in 2009,” explains Mr. Nojiri. “Based on the foundation thus developed, we have been able to gain support from a great number of investors, while also being propelled by the growing popularity of index trust funds, the launch of the New NISA scheme and various other factors.”

Seeking to familiarize more people with investment trust funds and increase the number of retail investors to 40% of the national population

Example of the lowering of management costs: Illustration of falling annual trust fee rates (calculated with tax included)

It should be noted that the fact that the industry’s lowest fund management costs have been achieved for the Orukan fund also contributes to its popularity. This achievement is attributable largely to the fact that, unlike conventional investment trust funds, this product is not sold over the counter but only available online. Not being trapped by conventional paradigms, the company has also minimized the printing of prospectuses, investment reports and other documents to further reduce management costs.

The concept of long-term investment has, moreover, become more widely instilled among Japanese investors, which is also believed to be a factor contributing to Orukan’s increased popularity. Index investment trust fund products are now popular among novice investors, and some of these investors are often under the mistaken apprehension that index fund products would never fall in value, which is of course not true for any financial product. Lots of investors in earlier times tended to redeem their investments immediately if the market value dropped. When the market faced sharp swings in August 2024, however, only a small number of investors reacted with such sensitivity. Rather, many investors reportedly said that they were taking a long-term view of the stock market.

Mr. Nojiri explains further: “Our company has been communicating the importance of making moderate investments from a long-term perspective. Some investors stopped making periodic investment or redeemed their funds during the market turbulence of August 2024, but the account closure rate was 1% or less for the Orukan fund. The company posts reports on various aspects of the market on its website, including on the importance of holding stocks for the long term despite sporadic drops in market value, and also shares information through its X and LINE accounts to help Japanese investors develop the habit of making periodic investment on a long-term basis.”

As symbolized by the popularity of the Orukan fund, the asset management market, which has not yet reached full-scale operation in Japan, is starting to see some big changes. Regarding the future outlook, Mr. Nojiri has the following to say: “The number of New NISA accounts opened has exceeded 24 million. The Japanese NISA scheme was modeled after the ISA scheme of the United Kingdom. Around 40% of the British population have an ISA account, and I hope that the number of NISA account holders will likewise increase to around 40% of the national population. We will continue to make efforts to make Japanese people more familiar with investment trust fund products.”

INTERVIEWEES

HIROAKI NOJIRI

Group Manager

Promotion Strategy Group, Customer Communication Division

Mitsubishi UFJ Asset Management

Tokyo Shiodome Building, 1-9-1 Higashi-Shinbashi, Minato-ku, Tokyo

Founded in August 1985. Formerly known as Mitsubishi UFJ Kokusai Asset Management, it adopted its current name in October 2023. As of the end of March 2024, the company has assets under management of 36.1 trillion yen (investment trust fund management) and 1.5 trillion yen (investment advisory services). It has a total of 897 officers and employees.

Its popular products include eMAXIS Slim All Country (“Orukan”) and the S&P 500-linked eMAXIS Slim US Stocks (S&P500) (“Slim S&P500”), which together have an estimated 10 million account holders. The amount invested in the S&P500 fund reached 6,035.7 billion yen as of the end of November 2024, making Slim S&P500 the first publicly offered investment trust fund with a balance exceeding six trillion yen (not including ETFs).