2024.11.21

Tokio Marine & Nichido enters the solutions business

Aiming to develop it into a new top revenue producer after the insurance business

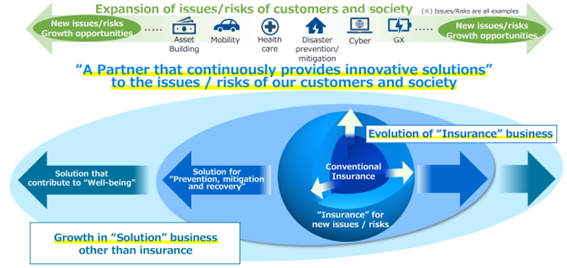

Tokio Marine & Nichido is committed to expanding the scope of its value proposition by addressing social issues such as disaster prevention and mitigation (resilience), cyber security, and healthcare.

Tokio Marine & Nichido is developing a new solutions business beyond the scope of existing

insurance.

Tokio Marine & Nichido's strength lies in the diversity and abundance of its customer

contact points in the non-life insurance business. At the time of policy renewal, employees

and agents had ample opportunities to hear customers' concerns and opinions about various

issues unrelated to insurance. However, regulations limiting the scope of services offered

prevented the Company from offering solutions beyond insurance products. The revision of the

Insurance Business Act has eased this restriction, enabling it to provide a broader range of

solutions. The Company's Mid-term Business Plan that started in 2024 sets the expansion of

its solutions business as a critical strategy, encouraging tackling social issues in a wide

range of areas from now on.

One of the new initiatives is to propose possible solutions through the business matching

platform "Bizicle by Tokio Marine & Nichido," which started in fiscal 2024. Using the

platform, employees and agents across the country introduce customers who have issues in

non-insurance areas to solutions offered by one of the group companies and affiliates. Karen

Ono of the Tokio Marine & Nichido Sales Planning Department explains:

"Our customers' issues are truly diverse, ranging from disaster prevention and mitigation,

human resources and labor, healthcare, and cybersecurity to business management issues. We

aim to protect our customers in their time of need as well as their everyday lives by making

solutions available for their various problems. Through the platform, we support employees

and agents in presenting non-insurance options to our customers and propose new value

outside insurance to deal with customers' social issues. By doing so, we hope to grow our

solutions business into a new pillar of revenue, next to our insurance business."

Tokio Marine's comprehensive strength makes solutions for diverse issues possible

"Bizicle by Tokio Marine & Nichido" is an IT tool jointly developed with BusinessTech, a

consolidated subsidiary of MUFG Bank, Ltd. The business matching scheme will be rolled out

in earnest using this platform.

We offer a variety of practical solutions proposed mainly by group companies. These include

consulting services on quantitative evaluation of natural disaster risks (disaster

prevention and mitigation), seminars for employees on balancing work and nursing care

(healthcare), and AI robot services for operation control support systems (mobility).

"In addition, we have integrated solutions covering a wide range of areas offered by partner

companies outside of Tokio Marine Group," says Ono. "Our insurance agents can introduce

their customers to the solutions best suited for their issues and needs. Meanwhile, we hope

informing our customers of solution providers through the platform and utilizing the data

accumulated there will also enable us to propose better insurance products and solutions."

We provide the optimal solutions for issues involving

transportation, logistics, and more

Emphasizing the solutions business is not an initiative by Tokio Marine & Nichido alone. The

entire Tokio Marine Group is focusing its full efforts on the business. In November 2023, a

new company was established as part of the Group: Tokio Marine Smart Mobility Co., Ltd. As

the name suggests, it offers mobility solutions for businesses, including reducing the risks

and costs involved in transportation and logistics, improving the work environment, and

strengthening the capability to respond to environmental challenges and automated driving.

Chieko Susumu of Tokio Marine Holdings explains:

"Today, mobility issues are multifaceted and go beyond accident prevention and safe driving.

They involve the decline in transport capacity due to the decrease in the number of drivers

(2024 issue), vehicle fleet management, driver labor and health management, and responses to

decarbonization and automated driving. Tokio Marine Group has offered various insurance

products for over 100 years, starting with automobile insurance. More recently, we have been

developing solutions using technology, such as auto insurance coverage with built-in drive

recorders and accident reduction support service using an AI-based risk level assessment

model. By bolstering these solutions, we want to better respond to customer needs and social

challenges."

For example, the complexity of mobility-related social issues in the transport industry

involves the interests of cargo owners, the reality of diverse cargo types and delivery

methods, and consumer needs that are inextricably entangled. It is challenging for any one

company to solve such a problem singlehandedly. An optimal solution requires collaboration

among all mobility players across the industry.

Using the latest technology and

collaborating with cross-industry partners

In response to this difficulty, Tokio Marine Smart Mobility offers the fleet management

service "MIMAMO DRIVE." The service was introduced as the first initiative of its kind in

April 2024 in collaboration with Tokio Marine & Nichido. It supports corporate vehicle fleet

management and safe driving by tapping into Tokio Marine Group's accident reduction and data

analysis know-how. Susumu elaborates:

"MIMAMO DRIVE allows companies to monitor real-time vehicle activities and diagnose safe

driving based on the vehicle operator's driving tendencies through data collected by IoT

devices installed in the vehicle. Daily reports are created automatically from the data

acquired, reducing the driver's workload. We hope to reduce vehicle management risks and

costs for the businesses through MIMAMO DRIVE."

Social issues concerning mobility must be tackled across the industry rather than by

individual companies. That is why the Group will involve various players to support efforts

to optimize the comprehensive whole.

"We want to use Tokio Marine & Nichido's diverse data, know-how, and customer contacts to

promote the use of the latest mobility technology and collaboration with partners from

different industries," says Susumu. "We are considering launching driver labor and health

management services. We will continue to assess our customers' issues quickly and accurately

to develop and provide new solutions."

INTERVIEWEE

Karen Ono

Tokio Marine & Nichido Fire Insurance

Sales Planning Department

Chieko Susumu

Tokio Marine Holdings

Business Design Department

Tokio Marine & Nichido Fire Insurance Co., Ltd.

2-6-4 Otemachi, Chiyoda-ku, Tokoyo

Established in 1879. With customer trust as the foundation of all its activities, Tokio Marine & Nichido Fire Insurance provides our customers with safety and security in cooperation with our agents, contributing to the continuing economic aspirations of an affluent and comfortable society while promoting initiatives and challenges based on our purpose: "supporting local communities and customers in their everyday lives and protecting them in times of need."